Renewable energies and energy efficiency – drivers of energy decarbonisation

Accounting for 76% of estimated global greenhouse gas emissions at the end of 2018 (1), energy is by far the sector where decarbonisation efforts must be focused.

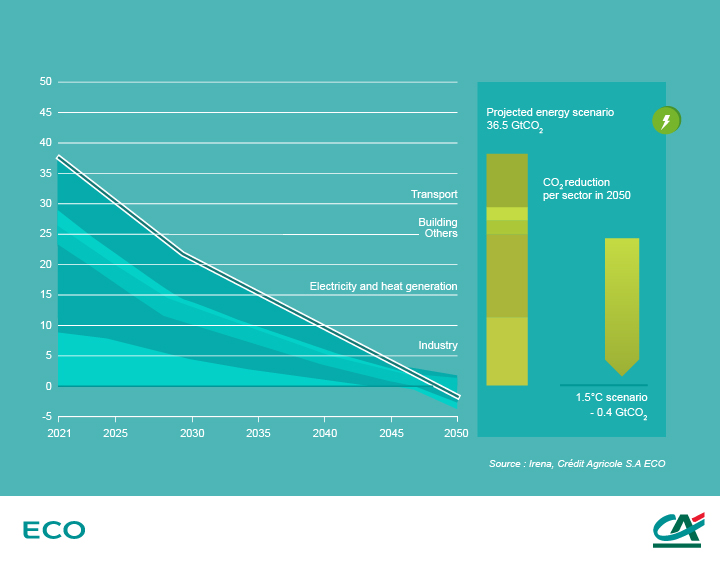

NET ANNUAL CO2 EMISSIONS (GTCO2/YEAR) WORLDWIDE

Achieving carbon neutrality (2) by 2050 would limit the increase in the planet's surface temperature to +1.5°C compared to pre-industrial levels. As such, the whole economic sectors need to reach carbon neutrality. In its "World Energy Transitions Outlook – 1.5°C pathway" report, the International Renewable Energy Agency (IRENA) considers that the 1.5°C scenario would be reached if global CO2-eq emissions were reduced by 36.9 Gt/year by 2050 compared to current levels (i.e. 1,200 times the CO2-emitted annually by the coal-fired power station with the highest emissions), and that the bulk of the efforts need to be focused on the electricity and heat generation sectors (35%) as well as industry (30%) and transport (23%).

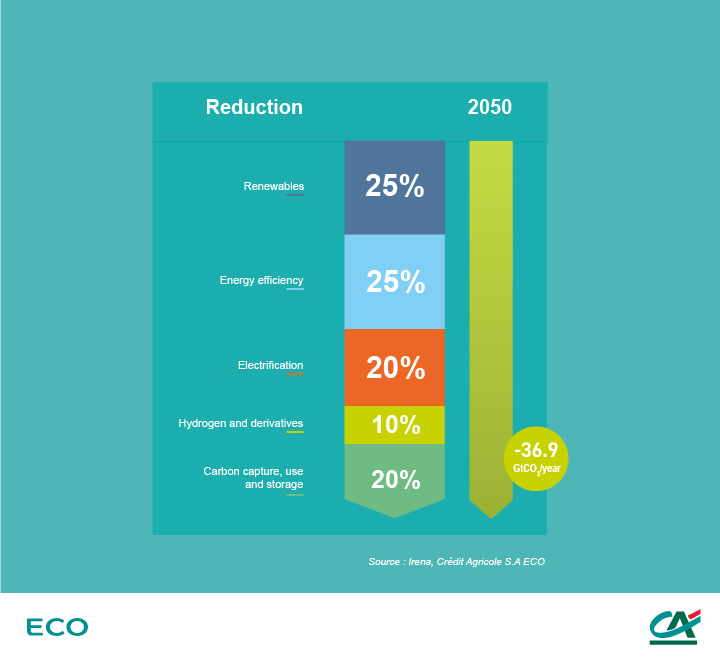

REDUCTION OF ANNUAL CO2 EMISSIONS IN THE GLOBAL 1.5°C SCENARIO

The first pillar of decarbonisation is the development of renewable energies, which will account for a quarter of greenhouse gas emission reductions by 2050. Energy efficiency measures, which will account for a similar proportion of GHG reductions, are another key component of this transformation. These measures help to improve energy performance standards and influence the behaviour of industrial players and individuals. Accounting for an estimated 20% of GHG reductions, electrification, particularly via heat pumps and the development of electric vehicles, will also help to significantly decarbonise energy use. Finally, accounting for around 30% of GHG reductions, hydrogen and its derivatives (including synthetic fuels), carbon capture and storage technologies (CCS) as well as CCS/bioenergy coupling for heat and electricity generation will also play a key role in achieving carbon neutrality (or "Net Zero").

Future investment needs are massive and must be released more quickly

The long-term investment that will be required is huge and estimated at $131 trillion over the period 2021-2050 (3) (approximately 1.5 times 2020 global GDP), including $115 trillion for the energy transition. Total annual energy investments, currently estimated at $2.1 trillion, will have to rise to around $4.4 trillion per year on average until 2050 to reach "Net Zero".

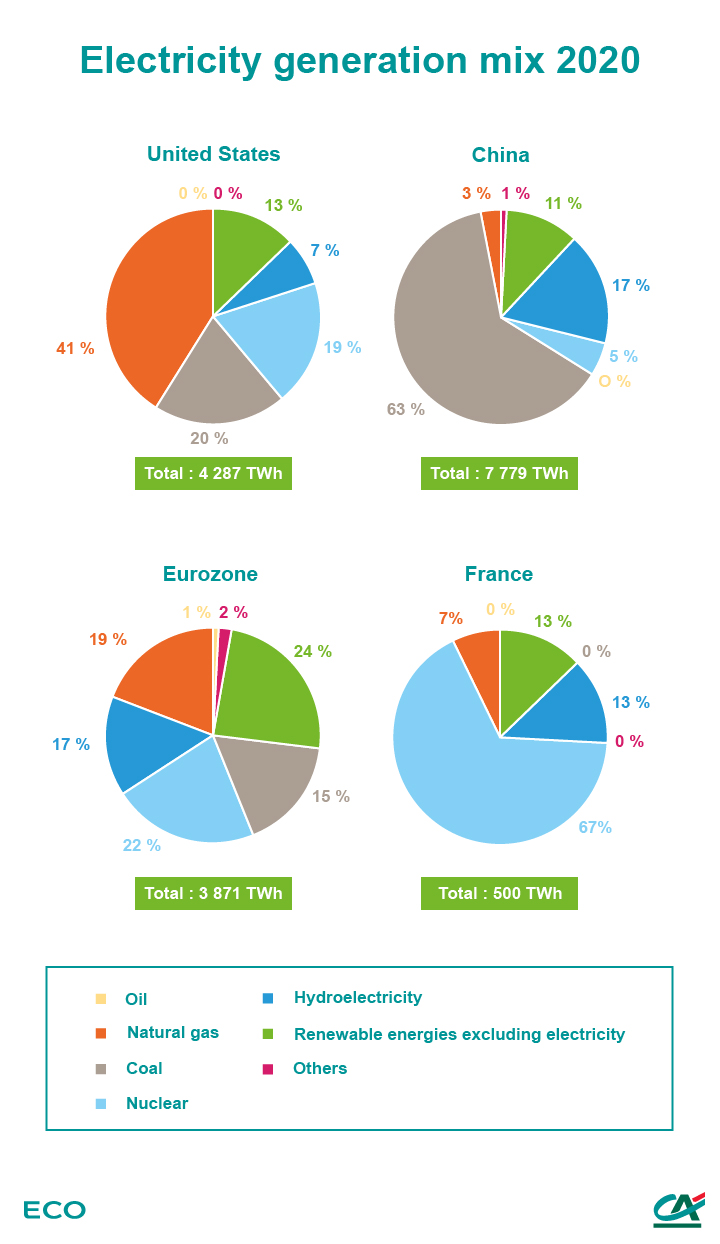

Electricity generation has seen the share of fossil fuel plants gradually decrease and renewable energies develop. With a share of around 28% in 2020 (4), renewable energies, including hydroelectricity, have become an increasingly important part of the global electricity generation mix since 2010 (20%), at the expense of coal-based production, which has dropped by 5% to 35%. The share accounted for by natural gas has remained stable at 23%.

The intermittent nature of renewable energy generation, coupled with massive future capacity development on the network, nevertheless poses many challenges for electricity systems that need a consistent supply/demand balance.

Various technological strategies will allow countries to decarbonise their energy mix more efficiently while continuing to provide a stable electricity network (5). The rollout of demand management mechanisms, the development of storage capacities using batteries, the generation of renewable hydrogen and, in the longer term, the miniaturisation of nuclear power plants (controllable and low-carbon by nature) are noteworthy. The network expansion needed to connect decentralised renewable energy generation sites and the use of new storage solutions is expected to require an investment of $22 trillion over 2021-2050 (6).

Historically, investments in energy transition were associated with a high level of risk. Lower generation costs and better knowledge of these different technologies (wind, solar) have made financing them easier. At the same time, the rise of so-called "green" finance has enabled capital to be directed towards decarbonisation through new tools such as green bonds, social bonds, green credits or bonds and sustainable credits.

Decarbonisation is shifting energy companies' long-term strategies

By reshuffling the cards in terms of future investments, decarbonisation is causing major energy sector players to shift their strategies.

This has resulted in increased investments in the renewable energies sector, through internal or external growth, including for certain oil and gas sector majors that have set up dedicated subsidiaries and are making this sector a strategic development focus. The oil majors will have to compete with certain large groups that already have a substantial presence in renewable energies such as European utilities. The path to decarbonisation will go hand in hand with strategic alliances that are reshaping a rapidly changing energy landscape.

(1) Source: Climate Watch, the World Resources Institute (2020)

(2) We refer to carbon neutrality when net anthropogenic CO2 emissions and, by extension, greenhouse gas emissions are offset on a global scale by the anthropogenic eliminations of CO2 (or greenhouse gases) during a given period. We also refer to “net zero emissions” or “Net Zero”.

(3) Sources: International Renewable Energy Agency (IRENA) – +1.5°C pathway

(4) Source: BP Statistical Review of World Energy & Ember

(5) Gas-fired power stations, which can be controlled and use the least carbon-intensive source of fossil energy, also contribute to the stability of the electricity network.

(6) Source: IRENA